The idea of retiring at 65 and living a life of leisure is becoming less feasible and less appealing for many. Traditional retirement, built on the assumption of a short post-career life funded by savings and Social Security, doesn’t account for today’s realities. People are living longer, healthcare costs are skyrocketing, and the desire to stay active and purposeful often outweighs the appeal of a fully idle life. This shift has given rise to the anti-retirement lifestyle, where more people rethinking what retirement can look like in a fast-evolving world.

The Shift in Retirement Mindset

Modern retirement isn’t what it used to be. The traditional idea of retiring to a life of complete relaxation is losing its shine. More people now view this phase of life as an opportunity for purpose and activity rather than slowing down entirely. Let’s explore how a new mindset is emerging, shaking up the concept of retirement.

Why Traditional Retirement is Losing Appeal

Retirement, as we know it today, didn’t always exist. The idea of stepping away from work as you age started taking shape during the Industrial Revolution when pensions became more common. Over the decades, this concept cemented around the notion of leaving work by age 65 to spend your golden years at leisure. Yet, this model no longer suits everyone.

There are several reasons people are rethinking traditional retirement:

- Longer life expectancy: Thanks to advancements in healthcare, people are living longer than ever. This means retirement could potentially last two or more decades. For many, this extended period without structure or purpose feels daunting rather than rewarding.

- Financial realities: Rising living costs, healthcare expenses, and inconsistencies in Social Security make it harder to save enough for a carefree retirement, leaving many feeling financially unprepared.

- Cultural shifts: Modern retirees desire more than rest. Many want to stay active, try new things, or make meaningful societal contributions.

The old vision of “relaxation-only” retirement is losing appeal in light of these challenges. People are starting to craft post-career paths that better align with their passions and financial situations. From a historical perspective, look at this detailed history of retirement, which traces its roots and evolution.

The Rise of Anti-Retirement as a Concept

On the flip side of traditional retirement lies an emerging trend called “anti-retirement.” This philosophy rejects the notion of stopping work or activity altogether. Instead, it embraces a lifestyle focused on pursuing passions, lifelong learning, and, in many cases, continued professional engagement.

Anti-retirement isn’t just a niche idea; it’s steadily gaining popularity. A report from the Anti-Retirement Movement highlights how retirees are reshaping life post-work, opting to stay involved in their communities or pursue entrepreneurial ventures. The data also reflects that:

- Over 50% of adults aged 55+ say they prefer an active or semi-active retirement.

- Many retirees return to the workforce in part-time roles or entirely new careers simply out of personal fulfillment.

- Others focus their energy on volunteering, starting small businesses, or stepping into mentorship roles.

Why is this shift happening? People want to feel alive and engaged, even after leaving traditional careers. For more insights on how anti-retirement is taking hold, check out this article on redefining retirement lifestyles.

Gone are the days of thinking about retirement as an “end.” For many, it’s become a new beginning, a chance to redefine purpose, stay curious, and live with intention.

Key Pillars of an Anti-Retirement Lifestyle

Choosing a lifestyle that defies traditional retirement norms means embracing a life filled with purpose, activity, and connection. This shift is about living intentionally while prioritizing what truly matters. Below, we’ll explore the main pillars of an anti-retirement lifestyle, offering insights into how retirees can thrive in this next chapter.

Redefining Purpose

One thing becomes clear for many retirees: life without purpose feels hollow. Retirement shouldn’t mean the end of ambition but rather a chance to redirect it. Whether it’s through pursuing passions like art or music, volunteering for a cause close to the heart, or even starting a new career, the options are limitless. For example:

- Some retirees channel their creative energies into painting, woodworking, or writing memoirs.

- Others dive into giving back by mentoring young professionals or joining nonprofit boards.

- Many explore new careers entirely, such as opening a small business or freelancing in their area of expertise.

Understanding your “why” becomes essential. According to this Greater Good Science Center guide, redefining purpose also enhances mental health and resilience. Focusing on meaningful activities makes retirement not about ceasing work but beginning something gratifying.

Prioritizing Health and Wellness

Without good health, it’s hard to enjoy any retirement lifestyle. Prioritizing physical and mental wellness helps ensure sustained energy and vitality. Here are key strategies experts recommend:

- Stay Active: Regular exercise, even as simple as daily walks or yoga, lowers the risk of chronic illness. Freedom Village notes that staying physically active improves physical and mental well-being post-retirement.

- Maintain a Healthy Diet: Eating nutritious, balanced meals supports body and mind. Reducing processed foods and focusing on whole, plant-based ingredients can be transformative.

- Combat Isolation: Loneliness can creep in when work connections disappear. Joining local clubs, reconnecting with old friends, or simply scheduling regular family calls helps maintain connection and staves off depression.

Mental health practices such as mindfulness or journaling also serve as valuable tools in keeping retirees emotionally grounded and positively connected to the world.

Embracing Lifelong Learning

Curiosity doesn’t retire. Lifelong learning keeps the mind sharp and brings a sense of accomplishment. Many retirees find joy in:

- Formal Education: Universities and online platforms offer courses tailored for seniors, ranging from learning a new language to exploring philosophy.

- Workshops and Hobbies: Whether it’s photography workshops or culinary classes, picking up a new skill is profoundly enriching.

- Self-paced Exploration: Reading, joining book clubs, or even delving into topics like history can provide endless intellectual stimulation.

Embracing new knowledge prevents cognitive decline and fosters connections with like-minded learners. Research cited by Senior Lifestyle underscores how continuing education boosts confidence, mental agility, and emotional well-being.

Pursuing Financial Independence

For many, the anti-retirement lifestyle generates income beyond traditional savings or pensions. Financial independence allows retirees to pursue their passions without financial stress. Some actionable steps might include:

- Creating Passive Income Streams: Rental properties, dividend stocks, or royalties from intellectual property provide steady revenue without constant involvement.

- Side Hustles or Hobbies: Turn a passion project into profit, whether selling handmade crafts, consulting, or teaching.

- Freelancing or Part-Time Work: Utilizing decades of career expertise in flexible roles keeps bank accounts and minds active.

Understanding financial health is critical, and diversity in income streams has benefits. This guide offers more tips on maintaining financial stability.

Building a Social and Community-Oriented Life

Loneliness can significantly impact the quality of life in retirement, which makes cultivating meaningful relationships a top priority. Community-oriented activities include:

- Joining Social Groups: Retirees often find joy in shared interests, from gardening clubs to sports leagues.

- Volunteering: Giving back fosters connection and purpose.

- Engaging in Local Events: Attend art fairs, neighborhood meetings, or library workshops to stay engaged with the community.

Building relationships takes effort, but doing so provides enormous returns in happiness and longevity. According to this article, retirees who nurture social bonds are less likely to face depression and more likely to live fulfilling lives.

Anti-retirement is about crafting a lifestyle that celebrates purpose, vibrancy, and connection during life’s golden years.

Examples of Anti-Retirement in Action

The traditional narrative of retirement is shifting. More retirees stay involved and find opportunities that bring joy, purpose, and excitement. Anti-retirement is not about resisting rest but creating meaningful experiences and sustaining fulfillment well into later years.

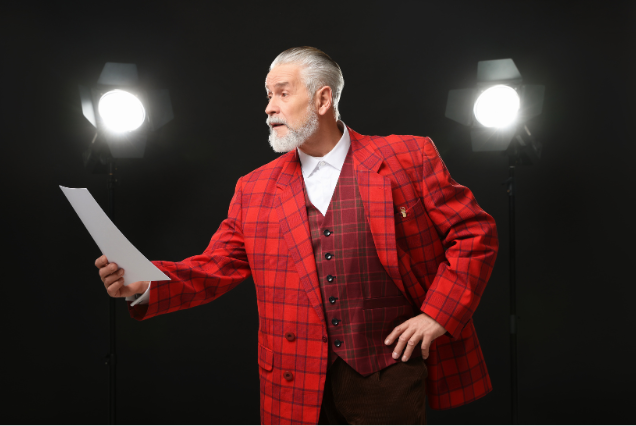

Second Careers and Entrepreneurship

Building a second career or launching a business after 65 might seem daunting, but for many, it’s the perfect opportunity to pursue long-held dreams. Stories of late-blooming entrepreneurs showcase the power of passion, persistence, and experience.

Take, for example, Colonel Harland Sanders, who founded Kentucky Fried Chicken at 65, proving age is just a number for success. Beyond Sanders, there are numerous examples of seniors redefining themselves professionally. People like senior entrepreneur Ronnie Dickerson, who started a consulting firm at 70, or individuals transforming their hobbies into thriving businesses. Interested in more inspiring stories? Check out seven entrepreneurs who started businesses after 60.

Why are these transitions so powerful? Retirees bring a wealth of knowledge and a unique perspective to their endeavors. Starting a second chapter in business or work can provide financial security and instill a renewed sense of purpose.

Active Travel and Adventure

For retirees, travel is no longer just about sightseeing; it’s about experiencing the world in a dynamic, active way. Many use their newfound freedom to explore adventurous destinations, from hiking the Appalachian Trail to embarking on road trips across continents.

Active travel isn’t about high-risk activities but finding joy in movement and exploration. Popular options include:

- Group hiking trips tailored for seniors.

- Cultural immersion tours focusing on food, art, or history.

- Travel opportunities that combine exploration with learning, such as photography retreats.

Planning an active retirement trip requires careful consideration of health, physical capabilities, and interests. If you’re looking for helpful advice, explore these tips for planning the perfect post-retirement trip.

Social Impact and Volunteering

Retirees are carving out impactful community roles through volunteering and social work. With decades of experience across various industries, many older adults find meaningful ways to give back.

Some of the top ways retirees contribute include:

- Mentoring Programs: Using their career expertise to guide younger professionals or students.

- Local Volunteering Efforts: Supporting food banks, schools, or community centers.

- National Initiatives: Joining organizations like Habitat for Humanity, which provides hands-on opportunities to change lives.

Volunteering helps communities and fosters an incredible sense of purpose and belonging for retirees. Curious about where to start? Consider exploring 9 top volunteering opportunities for seniors.

Staying engaged in these ways doesn’t just keep one active; it builds relationships, combats isolation, and contributes to a more fulfilling retirement journey.

Challenges and How to Overcome Them

Rethinking retirement comes with its own set of challenges. Balancing health, managing finances, and addressing societal expectations are hurdles potential retirees face. But the good news? There are actionable strategies you can rely on to face them head-on and thrive in a non-traditional post-work lifestyle.

Managing Physical and Mental Changes

Aging brings different changes, but staying proactive can help you maintain your physical and mental well-being. Here are practical tips to navigate this transition:

- Stay Physically Active

- Prioritize Mental Health

- Routine Check-Ups

- Engage Your Brain

Financial Planning and Risk Management

Pursuing a dynamic, purpose-driven retirement often requires recalibrating your financial plans. Here’s how to safeguard your goals in this new chapter:

- Diversify Your Savings

- Plan for Unpredictable Costs

- Budget for Enjoyment

- Seek Professional Guidance

Navigating Social Expectations

Sometimes, it’s the non-financial obstacles that weigh heaviest. When your choices deviate from the norm, pushbacks from friends, family, or society can bring emotional challenges. Here’s how to respond with confidence:

- Communicate Your Vision

- Build a Support Network

- Tune Out Negativity

- Show, Don’t Tell

Challenging the assumptions of conventional retirement is about more than embracing change; it’s about living authentically, even when the path isn’t the most traveled.

Tips for Starting Your Own Anti-Retirement Journey

Starting an anti-retirement journey is about reimagining how you spend the next phase of your life. It’s not about rejecting relaxation but creating a lifestyle filled with purpose, adventure, and meaning. If the traditional idea of retirement doesn’t excite you, here’s how to build a fulfilling path your way.

Identify What Truly Drives You

Before embarking on this new chapter, take some time to reflect on what lights you up inside. Finding your passion is a cornerstone of an anti-retirement lifestyle.

- Revisit Old Dreams: Were there hobbies or activities you set aside during your working years? Now’s the time to reconnect with them.

- Try New Experiences: Step out of your comfort zone. Exploring unfamiliar areas can spark newfound excitement, whether it’s art classes, travel, or starting a blog.

- Use Resources to Find Passions: Check out this guide on identifying passions in retirement. It details how retirees have turned interests into lifelong pursuits.

Your passions will serve as a compass, guiding you toward fulfilling activities.

Establish Your Long-Term Plan

An anti-retirement lifestyle requires a thoughtful plan. Spontaneity is fun, but having a structure ensures your pursuits align with your financial and personal goals.

- Set Financial Goals: Consider income streams like part-time work, freelancing, or passive investments.

- Create a Bucket List: Outline experiences or activities you dream of pursuing. Whether you’re traveling to new destinations or mastering a skill, this list will keep you focused.

- Stay Realistic About Commitments: Ensure your long-term plan matches your energy and resources. Overcommitting can lead to unnecessary stress.

For practical advice, explore this article on managing goals during retirement.

Surround Yourself with Support

Embarking on this personal journey can feel different from the norm, but having the right people around you makes the process more enjoyable.

- Family and Friends: Share your anti-retirement plans with loved ones; they can encourage or join you.

- Find a Community: Join groups or workshops where like-minded retirees connect to share ideas and inspiration.

- Seek Professional Help: Life coaches or mentors specializing in post-career planning can help refine your goals.

Social bonds and a support system will help keep you motivated and energized.

Focus on Flexibility

Your interests may evolve, so an anti-retirement journey isn’t about locking yourself into rigid commitments.

- Try different activities—some might stick, others won’t, and that’s okay.

- Allow yourself to adapt. If a project or hobby starts feeling like work, let it go and try something else.

- Take inspiration from others who’ve done the same. For example, Colonel Sanders started KFC after 65! Explore these stories of retirees finding a new purpose to stay inspired.

Remember, this phase of life is about celebrating freedom and pursuing joy without limits.

FAQs About Anti-Retirement

As more people embrace the concept of “anti-retirement,” it’s natural to question what it involves and how it fits into modern lifestyles. Here, we’ll go over some of the most common questions about this alternative approach to retirement.

What Is Anti-Retirement?

Anti-retirement refers to a lifestyle in which retirees reject the traditional idea of stepping away from work or active pursuits entirely. Instead, they choose to stay engaged by pursuing passions, part-time work, volunteering, or even launching second careers. It’s about continuing to live with purpose rather than slowing down or disconnecting.

Unlike traditional retirement, which might focus on relaxation and leisure, anti-retirement emphasizes activity, connection, and fulfillment. This lifestyle can include anything from mentoring younger generations to picking up new skills or starting a travel blog.

For a deeper dive, explore this podcast on the anti-retirement movement, which features insights into how retirees are reshaping life after work.

Is Anti-Retirement Financially Sustainable?

Yes, but it depends on planning and adaptability. Continuing to work, even part-time, or creating passive income streams often reduces the reliance on savings or pensions. Some people turn hobbies into profitable ventures, while others explore investments or side hustles to secure a steady income.

A key advantage of anti-retirement is its flexibility. You’re not bound to a fixed budget; you can adjust based on your income from active or semi-active pursuits. To learn more about retirement planning options that support such flexibility, check out these FAQs for additional insights.

Who Is Anti-Retirement Best Suited For?

Anti-retirement works well for individuals who thrive on activity, love staying social, or feel fulfilled by working toward goals. It’s not exclusive to those with prior careers, either. Hobbyists, artists, and lifelong learners often find joy and purpose in this lifestyle.

Does this mean anti-retirement isn’t for everyone? Perhaps. Some people still enjoy the traditional idea of leisure and relaxation. However, anti-retirement offers a vibrant alternative for those who find sitting back too dull or restrictive.

How Does Anti-Retirement Impact Mental Health?

Staying engaged and maintaining a sense of purpose can significantly boost mental well-being. Activities such as part-time work, volunteering, or learning something new offer a sense of accomplishment and belonging. Research consistently shows that mental stimulation and social interaction are key to reducing depression and cognitive decline in older adults.

For example, mentoring programs and volunteer opportunities provide an outlet to give back and offer emotional rewards. Social engagements help combat isolation, which is unfortunately common in traditional retirement.

Can Anti-Retirement Include Travel and Leisure?

Absolutely! Travel, adventure, and leisure are often integral to the anti-retirement lifestyle. The difference is that travel tends to be more active or experiential, such as joining educational tours, hiking excursions, or cultural immersion programs.

One of the benefits of this lifestyle is that it’s more about “slow travel” or meaningful, purpose-driven experiences than just ticking destinations off a list. Retirees often use the flexibility of their schedules to explore passions and stay active while traveling.

How Do You Transition to an Anti-Retirement Lifestyle?

Transitioning to anti-retirement starts with identifying what excites and fulfills you. Do you want to learn a new skill or pick up where you left off with an old hobby? Are you interested in continuing to work, even if it’s part-time? From there, you can set realistic goals and create a roadmap for your new lifestyle.

Another step is to ensure your finances align with your goals. Be mindful of budgeting, but leave room for spontaneity. For planning tips, consider this helpful guide on retirement financial planning.

Anti-retirement isn’t just about bypassing traditional retirement; it’s about reimagining your golden years with enthusiasm, purpose, and flexibility.

Conclusion

As we’ve explored, the old-school vision of retirement is no longer a one-size-fits-all solution. More people see this phase as an opportunity to reimagine their lives rather than simply stepping away. This shift reflects longer lifespans and desires for purpose, activity, and connection.

Why Traditional Retirement May Fall Short of Modern Needs

The traditional idea of retirement—exiting the workforce at 65 and relying solely on savings and pensions—is losing ground. Why? Life is longer, expenses are higher, and staying still feels outdated. What if that formula doesn’t suit everyone anymore?

- Lifespan Expansion: With people living into their 80s, 90s, and beyond, retirement might last as long as a working career. Early retirement thinkers never foresaw this modern challenge.

- Economic Pressures: Rising healthcare costs alongside housing expenses leave many retirees feeling the pinch. Social Security, for most, isn’t enough to live comfortably anymore. See how 80% of Americans struggle with financial security in retirement.

- Shifting Aspirations: From starting side hustles to actively traveling the world, today’s retirees crave fulfillment and purpose more than quiet living.

The Rise and Appeal of Anti-Retirement Lifestyles

Rejecting traditional retirement becomes a fresh, empowering choice. It doesn’t mean avoiding rest—it’s about redefining it. Anti-retirement layers activity (think purposeful pursuits like part-time work or community projects) into what’s traditionally been labeled “retirement.”

So, why is this catching on? Data-driven discussions, like the ones in this anti-retirement breakdown, show that aging doesn’t mean disengaging. Instead, it grants new growth opportunities.

Add comment